Why Walking Is the Best Medicine: A Physiotherapist’s Guide to Daily Walking Movement for Lifelong Health

This blog post is based on insights from Dr. Harshita (Physiotherapist)‘s YouTube video: “वॉक करना क्यों ज़रूरी है | Walking Benefits | Physiotherapist Dr Harshita

Thyroid and Menstrual Irregularities: Is Your Thyroid Secretly Sabotaging Your Periods? Understanding the Hidden Hormonal Connection

This blog post is based on insights from YouTube video: “थायराइड और मासिक धर्म: Thyroid और Periods में क्या Connection है?” Did you know that

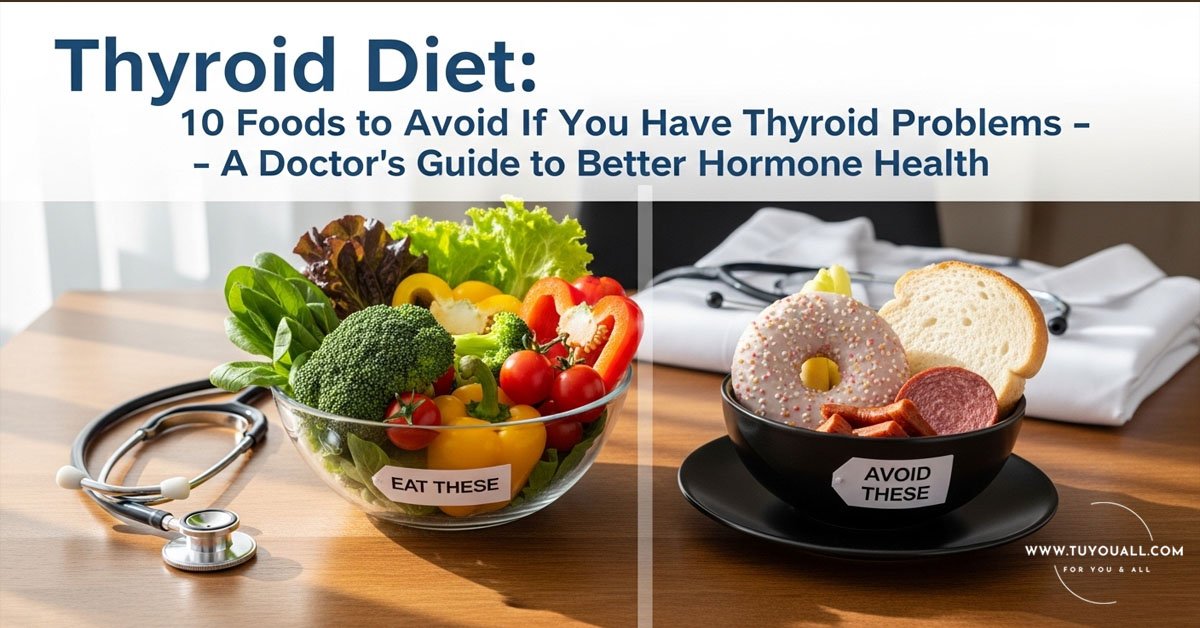

Thyroid Diet: 10 Foods to Avoid If You Have Thyroid Problems- A Doctor’s Guide to Better Hormone Health

This blog post is based on insights from Dr. Tanvi Mayur Patel‘s YouTube video: “10 Foods to Avoid for Thyroid Patients” from her channel dedicated

The Truth About Sexual Health Myths : Debunking Dangerous Myths with Dr. Cuterus

This blog post is based on insights from Dr. Tanaya Narendra (Dr. Cuterus)‘s YouTube interview with Raj Shamani on the Raj Shamani Clips channel. Have

The Smart Investor’s Guide to Systematic Withdrawal Plan (SWP): How to Generate ₹10,000+ Monthly Income Without Losing Your Principal

This blog post is based on insights from Rahul Jain’s YouTube video: “SWP का सही तरीका | Systematic Withdrawal Plan | Monthly Income from Mutual

Natural Ayurvedic Remedies for Premature Ejaculation: Ancient Wisdom for Modern Men

This blog post is based on insights from Dr. Deepak Kumar‘s YouTube video: “शीघ्रपतन का स्थायी इलाज | Premature Ejaculation Treatment | Dr. Deepak Kumar

Systematic Transfer Plan (STP) Strategy to Invest Lumpsum Amounts Smartly: Why STP Beats Timing the Market

This blog post is based on insights from Rahul Jain‘s YouTube video: “Lumpsum Investment Strategy: The Right Way to Invest Big Money in Mutual Funds”

SIP Investment Guide: How to Build Wealth with Systematic Investment Plans | Step-by-Step Tutorial

This blog post is based on insights from Rahul Jain’s YouTube video: “SIP Investment Guide: Data Proof & Strategy” Have you ever typed “Don’t do

Liquid ETFs Explained: How to Earn Daily Income from Idle Cash with Near-Zero Risk

This blog post is based on insights from Rahul Jain‘s YouTube video: “Liquid ETFs Explained: How to Earn Daily Income from Idle Cash with Near-Zero

Is Your Diabetes Diagnosis a Lie? The Hidden Tests That Could Change Everything

This blog post is based on insights from Dr. S. Kumar’s YouTube video interview titled “डायबिटीज है भी या नहीं? जांच लो पहले” (Do You

Hysterectomy Recovery Guide: What to Expect and How to Heal Faster After Uterus Removal Surgery

This blog post is based on insights from Dr. Seema’s YouTube video: “बच्चेदानी के ऑपरेशन के बाद कैसे रखें अपना ख्याल | Hysterectomy Recovery Tips”

How to Reverse Fatty Liver in 2 Months: A Complete Diet, Exercise & Natural Remedy Guide

This blog post is based on insights from Fit Tuber Hindi‘s YouTube video: “Fatty Liver: Causes, Symptoms & Natural Treatment” (translated title from Hindi). The

How to Legally Pay 0% Tax on SIP Withdrawals: A Complete Guide to FIFO & LTCG Optimization

This blog post is based on insights from Rahul Jain’s YouTube video: “SIP Tax Calculation: How to Pay 0% Tax on ₹9 Lakh Withdrawal |

How to Control Diabetes Naturally: 3 Simple Rules for Stable Blood Sugar Without Giving Up Rice or Roti

This blog post is based on insights from Dr. Salim’s YouTube video: “3 Simple Rules for Diabetes Control” (translated from Hindi). Introduction: Can You Really

How Thyroid Problems Affect Your Skin: The Hidden Connection You Can’t Ignore ‘Thyroid Skin Problems’

This blog post is based on insights from Dr. Tanvi Mayur Patel‘s YouTube video: “Thyroid and Skin Problems | Hypothyroidism & Hyperthyroidism Skin Symptoms” Have

From Zero to AI Generalist: Vaibhav Sisinty’s 5-Level Roadmap to Future-Proof Your Career

This blog post is based on insights from Vaibhav Sisinty‘s podcast appearance on Raj Shamani’s show: “AI Generalist: The Only Skill You Need in 2025

ETF vs Index Fund: The Truth About Hidden Costs That No One Tells You

This blog post is based on insights from Rahul Jain‘s YouTube video: “ETF vs Index Fund: किसमें ज्यादा पैसा बनता है? | Live Data Analysis”

Ayurvedic Water Drinking Rules & 4 Anti-Aging Fruits for Longevity | Natural Health Guide

This blog post is based on insights from an Ayurvedic Guru’s YouTube video: “शरीर दर्द पेट की समस्या और थकावट यह सारी बीमारियां खत्म करने

Always Feeling Like Something’s Stuck in Your Throat? Here’s Why (And How to Fix Throat Mucus)

This blog post is based on insights from Dr. Raman Abrol‘s YouTube video: “गले में बलगम का हमेशा फसा रहना | Chronic Throat Mucus |

Allergy Rhinitis: Natural Homeopathic Solutions for Lasting Relief

This blog post is based on insights from Dr. Prani’s YouTube video: “Allergic Rhinitis: Causes, Symptoms & Homeopathic Treatment” Ever woken up to a waterfall